In the fast-paced world of law, efficiency is paramount. Legal professionals are constantly implementing innovative ways to process their ever-growing caseloads. Automation has emerged as a powerful solution, modernizing the way legal cases get processed. By automating repetitive tasks such as document review, eDiscovery, and billing, lawyers can relieve valuable time to more complex aspects of their practice.

- Automation can significantly decrease the risk of human error, ensuring accuracy and adherence with legal requirements.

- Moreover, automated systems can help track case deadlines, coordinate appointments, and generate reports, optimizing overall case management.

The benefits of automation in legal case management are clear, assisting law firms to work productively.

Automating Financial Services for Enhanced Efficiency and Accuracy

Financial services sectors are undergoing a rapid transformation driven by the adoption of automation technologies. This advancements are the potential to substantially enhance efficiency and accuracy across a wide range of financial operations.

Automating routine tasks, such as transaction processing, releases valuable time for employees to focus on more sophisticated initiatives. By utilizing artificial intelligence (AI) and machine learning (ML), financial institutions can process vast amounts of data to identify patterns, forecast trends, and derive more sound decisions.

Moreover, automation strengthens accuracy by eliminating human error. Electronic systems operate with precision and consistency, leading to reliable financial records and summaries.

The benefits of automating financial services are diverse, including:

* Enhanced efficiency and productivity

* Reduced operating costs

* Elevated accuracy and reliability

* Quicker transaction processing

* Strengthened customer experience

The integration of automation in financial services is an ongoing trend.

As technology continues to evolve, we can expect even more sophisticated applications that will further transform the industry.

A Robust Legal Case Tracking System

In the demanding field of law, optimizing caseloads is paramount. A sophisticated litigation management platform can be a game-changer, empowering teams to enhance performance. By integrating routine tasks such as document processing, scheduling, and client engagement, legal professionals can focus more time to advising clients and building stronger cases.

- Utilizing a cloud-based case tracking system allows for real-time collaboration among team members, regardless of their location.

- With built-in dashboards, legal teams can gain valuable insights into case progress and key indicators.

- Robust data protection measures ensure that client information remains confidential and protected.

{Ultimately, a robust legal case tracking system can provide a significant competitive advantage by enabling law firms to achieve better outcomes. Implementing such a system is an investment in the future success of any legal practice.

Compliance Monitoring Simplified: Leveraging Automation for Risk Mitigation

In today's evolving business environment, organizations face a multitude of compliance requirements. Effectively monitoring observance to these regulations is crucial for mitigating risk and ensuring financial sustainability. Manual compliance monitoring can be resource-intensive, often leading to oversights. Utilizing automation technologies offers a effective solution for streamlining compliance processes and enhancing risk mitigation.

- Software can automate repetitive tasks, such as data collection, analysis, and reporting, freeing up valuable resources for more strategic initiatives.

- Continuous monitoring capabilities provide organizations with an ongoing understanding of their compliance posture.

- By identifying potential violations early on, automation allows for proactive remediation efforts.

This automated approach not only reduces the burden on personnel but also improves the accuracy and efficiency of compliance monitoring, leading to a more robust risk management framework.

Boosting Productivity: Automating Staff Tasks in the Financial Services Sector

In today's dynamically evolving financial landscape, institutions are under intense pressure to optimize efficiency and enhance productivity. Automation presents a powerful solution for streamlining operations and freeing up staff capacity for more strategic initiatives. By leveraging automation technologies, financial services organizations can substantially improve operational efficiency. here

Automating repetitive tasks such as data entry, document processing, and customer interactions allows employees to devote their efforts on higher-value activities that require human expertise. This not only enhances overall productivity but also minimizes the risk of errors and improves customer satisfaction.

Furthermore, automation can help financial institutions adhere with regulatory requirements by automating compliance processes and ensuring accurate record-keeping. The integration of automation technologies can also provide valuable data that enable organizations to make more informed business decisions.

As the financial services sector continues to evolve, embracing automation will be crucial for institutions to remain relevant. By automating staff tasks, financial services organizations can unlock new levels of productivity, efficiency, and profitability.

Compliance in 2024: Harnessing AI for Robust Oversight

The landscape of compliance is rapidly evolving, driven by increasing regulatory scrutiny and the demand for greater operational agility. To navigate this complex terrain effectively, organizations are increasingly turning to intelligent automation as a transformative solution. By leveraging advanced technologies such as machine learning and artificial intelligence, businesses can automate repetitive tasks, enhance monitoring processes, and detect potential compliance risks in real time.

- Intelligent automation empowers organizations to streamline their compliance workflows by automating routine tasks such as data collection, analysis, and reporting.

- Additionally, AI-powered algorithms can analyze vast amounts of data to identify anomalies and potential violations, enabling proactive risk mitigation.

- By freeing up human resources from mundane tasks, intelligent automation allows compliance teams to focus on more strategic initiatives, such as developing policies and procedures that align with evolving regulatory requirements.

Ultimately the adoption of intelligent automation represents a paradigm shift in the field of compliance, paving the way for more efficient, effective, and data-driven approaches to risk management.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! David Faustino Then & Now!

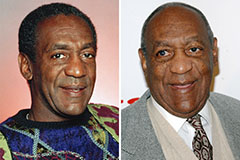

David Faustino Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!